For any newcomer seeking to start trading in today’s markets, one of the first decisions to make is which trading software to utilize. With so many options available, deciding on the ideal fit might be challenging. When choosing trading software, beginners should examine several important features.

Platform features include

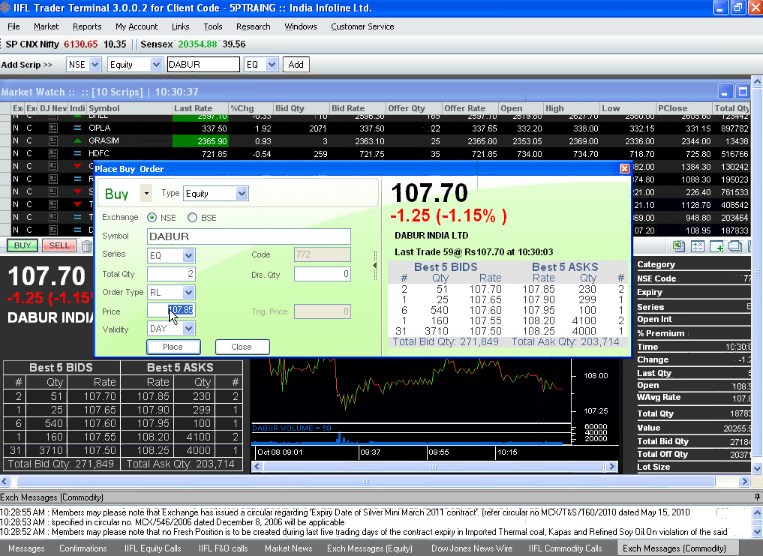

The features and functionality offered by the best trading platform is among the most crucial factors to consider. Beginners will prefer an app with simple tools for placing trades, monitoring positions, and analyzing markets. The ability to place both market and limit orders, charting capabilities, market news and alerts, and research tools are all important aspects to consider. Ease of use is especially crucial for first-timers, thus an intuitive interface is preferable to one that requires substantial training.

Selecting assets

Investors will gain access to a variety of markets, assets, and financial instruments through trading apps. Beginners should select a platform that corresponds to their preferred area of focus. Those interested in equities, for example, will want strong U.S. equity trading, whilst forex traders will demand currency pair support. Crypto aficionados require easy access to the most popular digital currencies. An app’s offered assets should match a beginner’s favored markets.

Fees and costs

All trading incurs charges, thus it is critical to understand an app’s fee structure. Look for modest trading commissions or none at all, as well as acceptable inactivity or account fees. Some platforms provide tiered pricing, in which costs fall as trade volume rises. Paper trading capabilities, which allow newbies to practice without jeopardizing their money, are also excellent for learning. Overall, when starting, an economical alternative with transparent pricing is best.

Education and Help

Because learning is an ongoing process, strong instructional resources, and customer assistance are especially beneficial to newcomers. Look for trading applications that include training, strategy articles, videos, and webinars. 24/7 forex trading open hours phone and live chat support ensures that help is available when it is required. Paper Money simulation modes are useful. Community forums can also be used to address inquiries from other users. Comprehensive schooling, along with help, makes the transfer to live markets easier.

Funding is made simple

Convenience is key, therefore apps with quick, safe funding via bank transfers, debit/credit cards, digital wallets, and other payment options decrease friction. Mobile check deposits, wire transfers, and foreign payment alternatives increase convenience. Trading becomes more accessible with lower minimum deposit amounts. The ease with which monies may be deposited and withdrawn improves the whole experience.

Regulation

Choose only apps regulated by major jurisdictions’ financial regulators, such as the SEC, FCA, or ASIC. Regulations, such as segregated accounts and disclosure rules, provide crucial investor safeguards. It verifies that the platform and any connected brokerages are legitimate entities. For further reassurance, stick with recognized, established brands, especially when depositing large funds. Long-term trust is established through regulation and a demonstrated track record.

Device compatibility

Mobile trading has become the norm, thus apps for iOS and Android smartphones provide access from any location. Web-based platforms can also be used on many machines. Some may also provide desktop applications for sophisticated charting, automation, and analysis. Multi-device usage offers versatility regardless of location. Trading on the go with smartphones and tablets is ideal for today’s lives.

Developing Your Skills With Advanced Tools

After learning the fundamentals of trading, many beginners will wish to improve their expertise by utilizing more advanced platform tools. Trading apps that include extra tools for technical analysis, automation, and research can assist beginning traders improve their skills.

Technical Analysis Tools

Advanced charting capabilities are useful for incorporating a variety of technical indicators into your trading approach. Look for programs that let you add overlays like moving averages, Bollinger Bands, MACD, and RSI to charts. The ability to apply numerous studies simultaneously and tailor inputs aids in the discovery of trading signals. Traders can use apps with sketching capabilities to create trend lines and discover patterns. More comprehensive charting enables technical traders.

Algorithmic and automated trading

For those comfortable with programming concepts, systems offering algorithmic trading interfaces open the door to automation.

Platforms with algorithmic trading interfaces enable users with minimal programming skills to automate strategies. Backtesting apps using past data allow traders to test ideas without risk before deploying them. Conditional orders and smart order routing automate trade entries and exits according to predetermined rules and conditions. Automation simplifies mechanical processes.

In-depth Market Research

Advanced research tools provide more detailed market insights. Apps with economic calendars, financial reports, and news feeds provide a steady stream of potentially market-moving data. Some offer analyst ratings, corporate facts, and SEC filings when studying particular stocks. Screeners enable traders to develop new ideas by filtering securities based on technical or fundamental criteria. Robust research provides traders with knowledge.

Customizable workspaces

Being able to completely personalize the trading interface improves workflow. Apps that allow traders to create numerous layouts, add/remove widgets, and change color palettes create a customized workspace. Saving several layouts for different strategies keeps the environment simple for everyone. Flexible settings increase productivity.

Portfolio Management and Reporting

As the number of roles increases, ongoing portfolio tracking and tax reporting solutions become more vital. Apps that provide aggregated views of assets, balances, gains/losses, and performance can help you manage the larger picture. Automated tax documents save time throughout the filing season. Comprehensive portfolio management provides structure.

Traders may constantly improve their skills on a single platform, thanks to powerful tools that boost technical prowess, automate procedures, power research, tailor workspaces, and manage portfolios. Upgrading to feature-rich apps facilitates a developing strategy.

Conclusion

In conclusion, taking into account essential elements like available features, asset selection, fees, education resources, funding alternatives, regulation, and compatibility can assist novices in selecting the best trading app for beginners that meets their demands in today’s markets. While experience is gained over time, choosing the correct platform from the start speeds the learning process. With the forex market open 24 hours a day, five days a week, access is critical for individuals trading during off-market hours. Overall, selecting an affordable, full-featured program from a reliable source prepares beginners for a smooth transition into real trading.