Bitcoin, the pioneering cryptocurrency, has captivated the world’s attention since its inception in 2009. While its core technology, blockchain, has revolutionized the financial industry, Bitcoin in 2025 has experienced remarkable volatility, making it a subject of both fascination and speculation. In this article, we will delve into the history of Bitcoin’s price, factors influencing its valuation, and its potential future.

The Historical Price Journey

Bitcoin’s price history is a rollercoaster ride that has left many investors exhilarated and others disillusioned. The cryptocurrency began its journey as a digital experiment with virtually no monetary value. In the early days, it was mined by a small group of enthusiasts who believed in the technology’s potential. The first recorded Bitcoin transaction took place in May 2010 when 10,000 BTC was exchanged for two pizzas, worth around $25 at the time. This marked the birth of Bitcoin’s value, albeit an extremely modest one.

Over the years, Bitcoin’s price gradually increased, reaching $1 in 2011 and $100 in 2013. However, it was in 2017 that Bitcoin captured global attention. Its price soared from around $1,000 at the beginning of the year to nearly $20,000 in December, creating a euphoria reminiscent of the dot-com bubble.

After that meteoric rise, Bitcoin experienced a significant crash, with its price dropping to around $3,000 by the end of 2018. This plunge raised questions about the sustainability of the cryptocurrency. Skeptics believed that Bitcoin’s bubble had finally burst, while enthusiasts saw it as a natural correction.

Since then, Bitcoin price has been characterized by periods of growth and consolidation. It regained its value, reaching new all-time highs in 2020 and 2021, trading at over $60,000. The adoption of Bitcoin as a store of value by institutional investors and the integration of cryptocurrencies into mainstream financial systems contributed to this remarkable surge.

Factors Influencing Bitcoin Price

Several factors influence Bitcoin’s price, making it a complex financial asset to analyze. Here are some key drivers:

- Supply and Demand: Bitcoin’s supply is capped at 21 million coins, making it deflationary by design. As more people seek to buy Bitcoin, its price rises due to increased demand and limited supply. The scarcity of Bitcoin has been a crucial factor in driving its price higher over time.

- Market Sentiment: The cryptocurrency market is highly sentiment-driven. Positive news, such as institutional investments or government recognition, can trigger a bullish sentiment, while regulatory crackdowns or security breaches can cause panic selling.

- Adoption and Use Cases: As Bitcoin gains more adoption as a means of payment and store of value, its price tends to rise. Use cases such as remittances, online purchases, and investments have contributed to its growing popularity.

- Guideline: Unofficial laws can essentially influence the cost of Bitcoin. Announcements of stricter regulations can cause a temporary decline, while regulatory clarity and support can boost its value.

- Market Speculation: Speculation plays a vital role in Bitcoin’s price volatility. Traders often enter the market to capitalize on short-term price movements, leading to sharp fluctuations.

- Macro-economic Factors: Economic crises, inflation, and currency devaluation in traditional financial systems can drive individuals and institutions to seek alternative assets like Bitcoin, causing its price to rise.

- Technological Developments: Upgrades and developments in the Bitcoin network can influence its price. Improvements in scalability, security, and usability can attract more users and investors.

The Future of Bitcoin Price

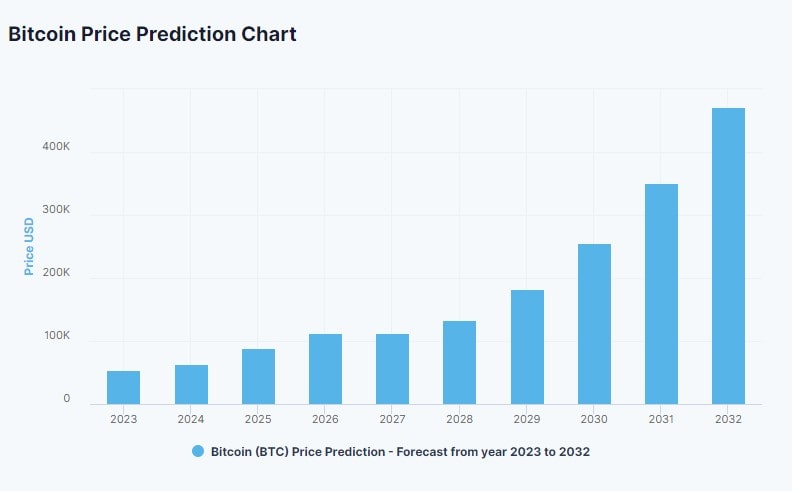

Predicting the future price of Bitcoin is a challenging task due to the complex and dynamic nature of the cryptocurrency market. However, several trends and developments can provide insights into Bitcoin’s potential future:

- Mainstream Adoption: As Bitcoin becomes more integrated into traditional financial systems and recognized by governments, its price may continue to rise. Institutional investments, like Bitcoin ETFs and pension funds, could contribute to this adoption.

- Market Maturity: As the cryptocurrency market matures, it may experience reduced volatility, making Bitcoin a more stable asset for investment and transactions. Regulatory clarity and investor protection measures could encourage more institutional participation.

- Technology Improvements: Ongoing developments in the Bitcoin network, such as the Lightning Network for faster and cheaper transactions, could enhance its utility, making it more attractive to users and investors.

- Economic Uncertainty: In times of economic turmoil or high inflation, Bitcoin may serve as a safe-haven asset, attracting capital from traditional financial markets.

- Competing Cryptocurrencies: The rise of other cryptocurrencies could influence Bitcoin’s price. If a new digital asset with superior technology and use cases gains popularity, it might divert some investment away from Bitcoin.

- Regulatory Changes: Evolving regulations can have a significant impact on Bitcoin’s price. Stricter regulations may lead to a temporary decline, while supportive policies could drive its value higher.

- Market Sentiment: Market sentiment will continue to play a crucial role in Bitcoin’s price. Positive news and developments can lead to periods of rapid appreciation, while negative sentiment can result in sharp corrections.

In Conclusion

Bitcoin price history is a testament to its incredible journey, from being practically worthless to reaching unprecedented highs. The factors influencing its price are multifaceted, from supply and demand dynamics to market sentiment and technological developments. While predicting the exact future price of Bitcoin remains uncertain, it is clear that the cryptocurrency has secured its place in the global financial landscape.

As Bitcoin continues to evolve, adapt, and gain recognition, it has the potential to become a more stable and widely accepted asset. However, it is essential to approach Bitcoin as a high-risk, high-reward investment, considering its volatility and the ever-changing regulatory environment. Whether you see it as a speculative opportunity or a long-term store of value, understanding the factors that influence its price is crucial for making informed investment decisions in the world of cryptocurrencies.